Look, I get it, finding an investor can be hard enough. According to the Angel Capital Association, only 300,000 angel investments were made last year, which is pretty small number considering the amount of businesses and startups that were looking for funding.

But yet, even with how challenging it can be to find funds, seeking out the right investors is going to not only contribute the right resources, connections, and expertise but can also be what makes your business grow tenfold. Below we’ve listed out a few common traits you can look for in investors, and why it makes them worth the extra search.

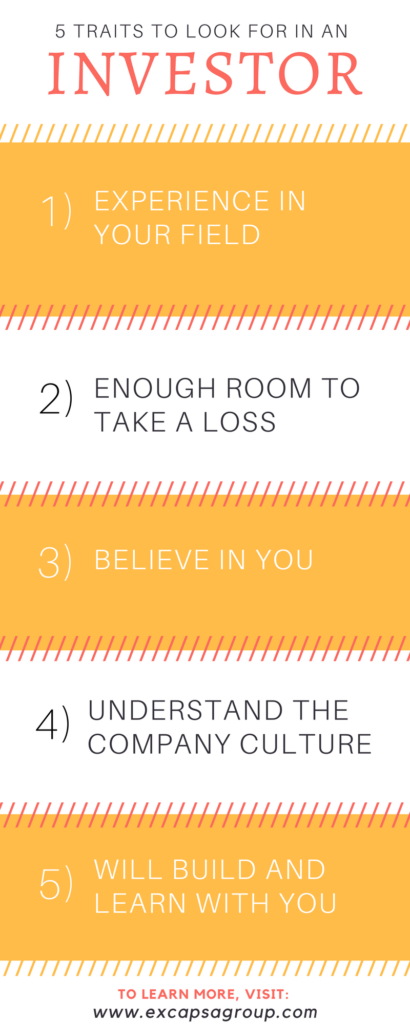

They have experience in your field

Off the bat, you’ve brought on someone on much wiser from their time in the field, giving you a potential leg up on competition that took a different direction. Additionally, investors that have worked in your industry have connections that could provide potential clients or customers. Also, these people usually have a sense of passion or personal connection to the field you’re working in, giving you someone that’s inspired and who sincerely wants to make a change.

While all of these factors play a role in setting a foundation of who to look for, the biggest factor comes down to one thing: treating this as any other person joining your team. What value are they going to bring? How will they be helpful? What’s the day-to-day going to be like with them in the office? How long will they be here? Thinking about them in this light will help with initial connections in no-time.

They have enough room to take a loss

Not only is this a note about their financial security, but also their outlook on investing. Angels or VC’s that have an understanding of startup companies success rate are going to be much better to work with. By knowing the success rate, their intentions take a different direction…perhaps to invest in a local community or even having previous experience in a similar firm. Plus, by focusing on progress rather than financial success, they’re to consider additional ventures down the road. Overall, the key to these investors is that they’re interested in helping individuals grow rather than just companies.

They believe in you and your team, not just your idea

As we just stated above, the best investors are about the people behind an idea rather than just solely the idea. Why? Because by knowing that a startup might not be successful, they want to build a relationship with those they feel like can keep pushing the envelope. Even in the scenario of an acqui-hire, an investor has the reasonable expectation that the team will take the knowledge they’re cultivating at a new firm and apply it to a future endeavor. As people take time and room to grow, the goal here isn’t necessarily to just put money into a unicorn, but to create a unicorn-building factory.

They have an understanding for how a company’s culture builds over time

When your business reaches a certain level of success, it means that the culture that came with it is going to shift also. Unfortunately for most, this is going to cause some growing pains along the way, which might mean turnover is going to increase.

If this situation arises, the best thing to do would be to define clearly the type of culture and mindset you’re trying to establish. Focus on having a vision of growth, and how each individual piece comes into place. As you’re trying to find folks that are committed to the growth of your company just as much as you are, it’s also imperative to find those that are going to fit within the current climate. When raising funds, investors want to see an established model of how you’re going to accomplish this.

They’re out to build and learn with you as well.

Whether they’ve made their fortune or not, an investor should always hold a natural curiosity to learn. Considering this is still their active career, it should be something they want to make progress in. Quite simply, the best shareholders are going to have just as much of a stake in taking the lessons from success or failure as you have.